Applying for SNAP (Supplemental Nutrition Assistance Program), which helps people buy food, can feel a little confusing. You might be wondering about all the paperwork and if you need to dig out your old tax returns. This essay will break down whether you need a tax return for SNAP, and what other information might be important to have ready when you apply. We’ll look at different situations so you’re prepared to get the help you need.

Do I Absolutely Need a Tax Return?

No, you don’t always need a tax return to apply for SNAP. SNAP applications primarily focus on your current income and resources. That means what you’re earning right now, not necessarily what you earned last year (unless that information helps to understand your current situation). While a tax return can sometimes be helpful, it’s not always a requirement for the application process.

Income Verification: What They Really Want

SNAP wants to know about your income. This is the most important factor. This includes money coming in from things like a job, unemployment benefits, or social security. They want to know how much you are earning, and where it’s coming from. They may ask for proof of your income.

One way they verify your income is by looking at pay stubs. If you’re working, you’ll usually get these every pay period. These pay stubs give information about how much you earned and what was taken out in taxes, but that’s not always the information they are looking for. They will often ask for your most recent pay stubs, usually from the last month or two.

Another way income can be verified is through a letter from your employer. This is just to confirm how much money you make. The letter confirms your income, and how often you receive it. Keep in mind, that if you change jobs during the SNAP process, it may affect the funds you get. If you are self-employed, the process may differ and you should check with your local SNAP office to find out what you need.

- Pay stubs are a common form of income verification.

- Letters from employers also work.

- Unemployment statements can be used as proof.

- Be sure to have all the necessary paperwork.

Assets and Resources: What Else Matters

Besides income, SNAP also looks at your resources, which are things you own or have access to. This includes things like money in your bank accounts or any other savings you might have. The amount of resources you have can affect your SNAP eligibility.

It’s important to know that things like your home and car usually aren’t counted as assets. The value of these are not counted towards whether or not you qualify for SNAP. However, there can be exceptions to this. The state may have rules on what assets are counted and what aren’t.

When you apply, be ready to provide information about any bank accounts or savings you have. They may want to see bank statements to verify how much money you have. It’s always a good idea to have this information ready, as it speeds up the application process.

Here’s a simple list of things you might need to provide information about when applying:

- Checking account balances.

- Savings account balances.

- Stocks and bonds (if applicable).

- Cash on hand.

How Tax Returns Can Still Help

Even though you don’t always need a tax return, they can still be helpful in certain situations. For instance, if you are self-employed, your tax return might be a useful piece of information to provide the state with.

Sometimes, a tax return can give you information you need. If you claimed certain deductions, like childcare expenses, on your tax return, this can lower your taxable income. Depending on what you claimed, you might want to have your tax return to show these. Remember that these things might affect your SNAP benefits.

If you have any questions about the application process, be sure to ask the SNAP office in your area. They will be able to answer all of your questions. It’s best to call and ask questions before and during the process. This is very helpful if you’re confused by the process.

Here’s a quick example of when a tax return might be useful:

| Situation | Tax Return Use |

|---|---|

| Self-Employed | Provides proof of income and expenses |

| Claimed certain deductions | Shows documentation of those expenses |

What To Do If You Haven’t Filed Taxes

Don’t worry if you haven’t filed taxes! It’s not a problem for SNAP. Like we said, SNAP applications mostly focus on your current income. If you haven’t filed, the SNAP office won’t penalize you.

If you haven’t filed because you didn’t make enough money, that’s okay. If you didn’t have to file taxes, you may still qualify for SNAP. The application will ask about your income, not your tax filing status. The application process looks at what you are currently making, not at your previous income.

Instead of a tax return, focus on gathering information about your current income. This includes pay stubs, bank statements, or any other proof of income you have. Be ready to provide it when you apply.

Here’s what you can focus on instead:

- Gathering recent pay stubs.

- Getting bank statements.

- Organizing any income verification documents you have.

- Contacting your local SNAP office for advice.

Special Circumstances: Students and the Self-Employed

There are certain situations where things can get a little different, like if you’re a student or self-employed. For students, there are specific rules about income, especially if you are receiving financial aid. You will need to provide documentation of this aid.

Self-employed individuals may have different requirements. SNAP may need different information about your income and expenses. You may need to show your tax returns, so it’s important to know what information you have to provide. It’s important to check with your local SNAP office.

The best thing to do is ask your local SNAP office. They can explain what you need to provide. They know the specific rules and requirements of your state, and they can give you the best guidance.

Here’s a quick chart of some things you might need to know:

| Group | Considerations |

|---|---|

| Students | Financial aid documentation |

| Self-Employed | Income and expense documentation |

Applying for SNAP: The Steps to Take

When you’re ready to apply for SNAP, you’ll usually start by filling out an application. You can often do this online, or you might need to go to a local office. You will need to gather the right paperwork, which may include the items we’ve discussed.

After you fill out the application, you’ll probably have an interview. This is where they will verify the information on your application. Be honest and answer all the questions. They might ask about your income, resources, and living situation.

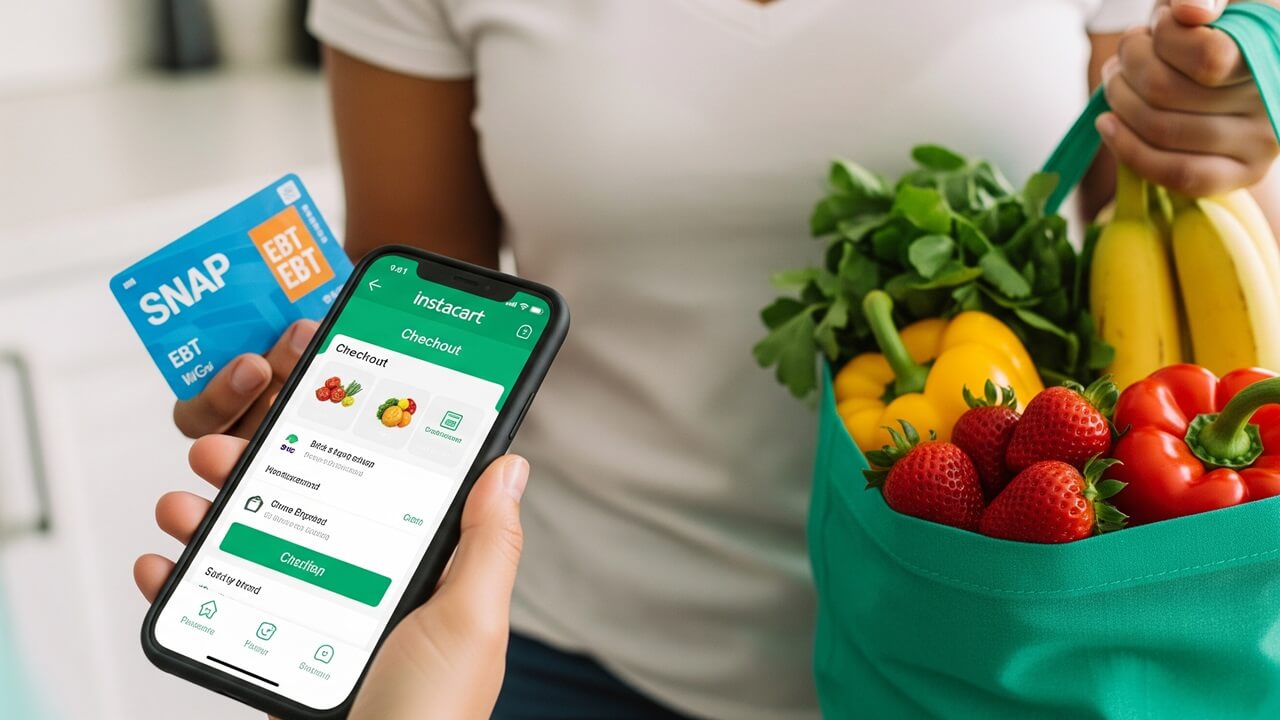

After the interview, they’ll review your application and decide whether you are eligible. If approved, you will get a SNAP card. You can use this card to buy food at grocery stores.

Here’s a basic application checklist:

- Fill out the application.

- Gather required documentation.

- Attend the interview.

- Receive SNAP card (if approved).

The Takeaway: Information is Key

So, to recap: You don’t always need a tax return to apply for SNAP. What’s really important is having the information needed for your current situation. Gather proof of income, bank statements, and any other documentation they ask for. If you’re unsure, don’t be afraid to contact your local SNAP office. They are there to help you understand the process and get the food assistance you need.